High Returns. Cash Flow. Tax Benefits. Why Choose Between Them?

Multifamily investing has earned a reputation as a high-performing wealth-building tool for a lot of good reasons. First, momentum is building. Thanks to high occupancy and double-digit rent growth, investors are flocking to the sector to enhance and diversify their portfolios.

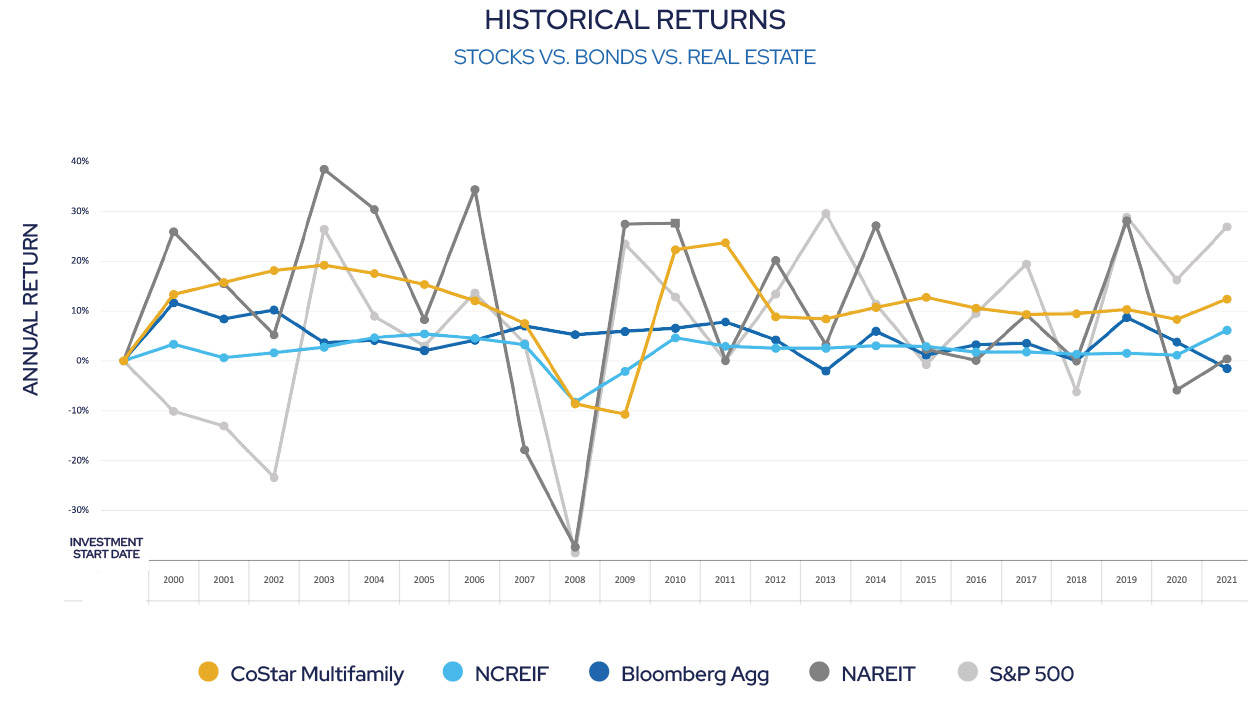

And the numbers tell us why. Data from CoStar, NCREIF’s Property Index, Bloomberg’s U.S. Aggregate Bond Index, NAREIT, and the S&P 500 paint a clear picture: multifamily real estate has shown less volatility than stocks and REITs, is not closely correlated to the stock market, and has outperformed bonds in annual returns in all but two of the past 23 years (as of May 8th, 2023).

Add to that the guarantee of reliable, steady monthly cash flow from renters and some impressive tax incentives – it’s no wonder multifamily investing is known as today’s overachiever. How can we help? Growth Legacy Capital offers accessible syndication – individual investors can pool their resources, making multifamily investing more accessible to people like you. In short, we want to help you grow your wealth.

Creating A Passive Income Stream

Building a Legacy of Wealth, Engineered for Software Professionals